Synopsis

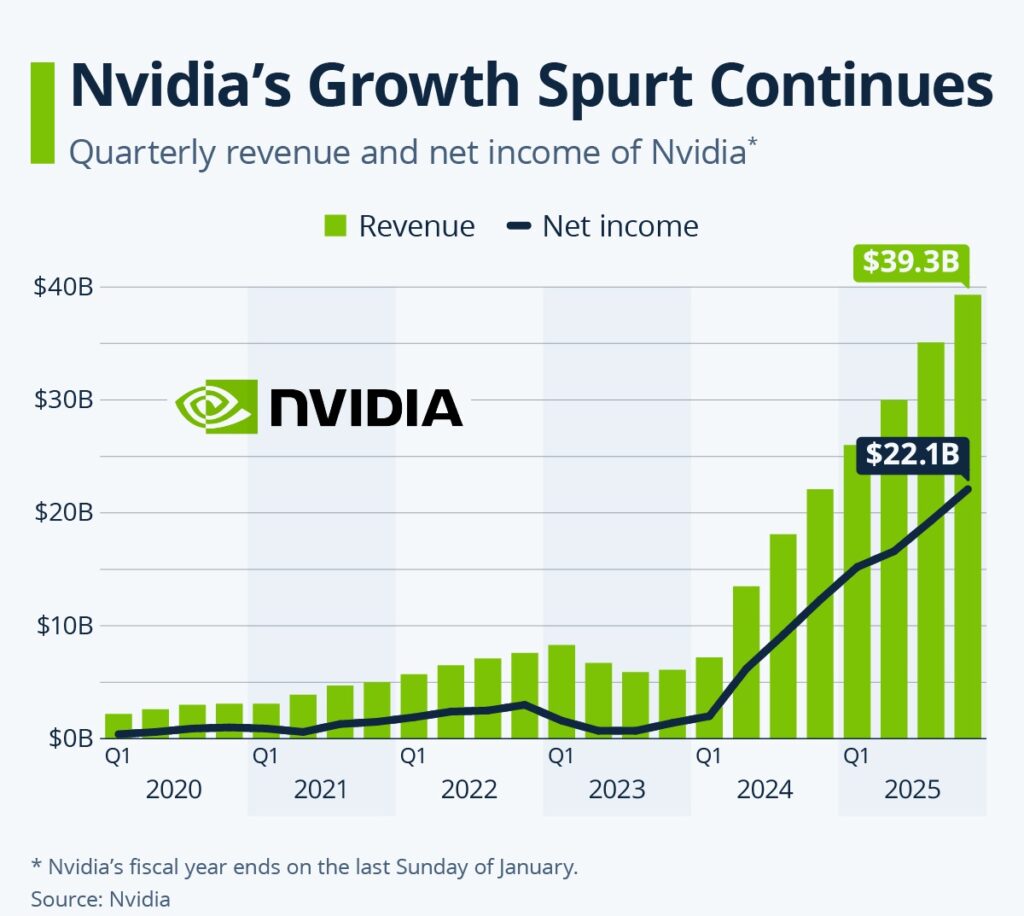

NVIDIA Corporation (NASDAQ: NVDA) has once again demonstrated its dominance in the tech industry with its Q1 2025 earnings report. Despite facing significant geopolitical challenges, the company reported unprecedented revenue and earnings, underscoring its pivotal role in the AI and semiconductor sectors.

Financial Highlights:

Revenue: $26.04 billion, marking a 262% increase year-over-year (YoY) and an 18% rise quarter-over-quarter (QoQ).

Net Income: $14.88 billion, up 628% YoY.

Earnings Per Share (EPS): $5.98 (GAAP), surpassing analyst expectations.

Gross Margin: 78.4%, reflecting efficient cost management and high-margin product sales.

Segment Performance:

- Data Center: Achieved a record $22.6 billion in revenue, a 427% increase YoY. This growth was driven by the adoption of NVIDIA’s Hopper GPU platform for AI applications.

- Gaming: Generated $2.6 billion in revenue, an 18% increase YoY, despite an 8% QoQ decline due to seasonal factors.

- Professional Visualization: Reported $427 million in revenue, a 45% increase YoY, fueled by demand for AI-enhanced design

- Automotive: Revenue reached $329 million, up 11% YoY, driven by the adoption of NVIDIA’s DRIVE platform for autonomous vehicles.

Strategic Developments:

- Blackwell Platform Launch: Introduced the Blackwell architecture, designed for trillion-parameter AI models, enhancing computational capabilities for generative AI.

- Partnerships: Expanded collaborations with major cloud providers like AWS, Google Cloud, and Microsoft Azure to integrate NVIDIA’s AI solutions into their infrastructures.

- Global Expansion: Initiated sovereign AI projects in regions such as the Middle East and Europe, diversifying market presence amid geopolitical tensions.

Geopolitical Challenges:

Despite robust financial performance, NVIDIA faced challenges due to U.S. export restrictions on AI chips to China. The company incurred a $4.5 billion charge related to unsold H20 chip inventory and anticipates an $8 billion revenue loss in the next quarter due to these restrictions.

NVIDIA projects Q2 2025 revenue to be approximately $28 billion, with continued growth expected across all segments. The company remains committed to innovation and expanding its leadership in the AI and semiconductor industries.

NVIDIA’s Q1 2025 earnings report highlights its resilience and strategic foresight in navigating both market opportunities and geopolitical challenges. With strong financials, innovative product offerings, and a global expansion strategy, NVIDIA is well-positioned for sustained growth in the evolving tech landscape.